is pre k tax deductible

In most circumstances you wont get a significant break on your taxes by sending your kids to a private school from kindergarten to grade 12. For parents who are responsible for childcare handling the cost of bringing up children can be challenging.

Books Children Must Read Preschool Books Childrens Reading Books

You can claim the part of pre-k that is daycare not schooling ie.

. Is pre-K tuition deductible. The good news is this can apply as a child and dependent care credit. Is Private School Tuition Tax Deductible.

This lets employees save for retirement and reduce their taxable income. Are Preschool Expenses Tax Deductible. Nursery school and other prekindergarten costs generally qualify for the Child and Dependent Care Credit because the educational benefits are considered incidental to the child care costs.

Private school tuition even when paid to a church cant be considered a donation. In addition the credit is limited by the amount of your income and to qualify you. Preschool fees are generally not tax-deductible from a parents taxes.

Expenses for overnight summer camps kindergarten and first grade or higher dont qualify for the Child and Dependent Care credit. Theres no pre-k deduction. December 18 2021 Tax Deductions.

Is there tax relief for preschool parents. First and foremost you should know that preschool tuition isnt technically tax deductible. Nursery school preschool and similar pre-kindergarten programs are considered child care by the IRS.

It is not possible to deduct private school tuition expenses. However expenses for before- and after-school care of a child in. But before we get too carried away with thoughts of what to do with that.

Summer day camps also count as child care. A deductible expense is the one you can subtract from your income to reduce your tax liability. Tuition is not deductible on federal income taxes but parents have other options to reduce costs.

And thanks to recent changes in the tax law the benefits for preschool tuition paid during the 2021 tax year are greater than ever before. However the expenses for a before- or after-school care program of a child in kindergarten or a higher grade may qualify even though the expense of school. Additionally you might consider education-focused investment options such as a Coverdell Education Savings Account Coverdell ESA or a 529 plan.

Im pleased to say that under certain circumstances you can indeed claim a tax benefit for preschool tuition. Tax Breaks for Private K-12 Schooling. In the past some tax commentators have suggested that parents who pay tuition to send their children to full-day kindergarten should be allowed to apportion some expenses to the care of the children.

Some of the most common questions we get are Is private preschool tax deductible and Is catholic school tuition tax deductible In both of these cases the answer will always be no. If your child attends a K-12 private school there is no federal tax deduction or credit you qualify for that will help pay for tuition not even school uniforms. A credit called the Child and Dependent Care Credit worth up to 1050 for one child and up to 2100 for two or more kids.

No tuition for kindergarten isnt a qualifying expense for the child and dependent care credit because expenses to attend kindergarten or a higher grade are educational expenses rather than childcare expenses. The Internal Revenue Service doesnt allow you to deduct private school tuition to lower your federal tax liability. Some retirement plans are eligible for pre-tax deductions such as certain IRAs and 401 k plan types.

The sum of your childs entire preschool tuition is not tax deductible but you may be able to get something better than a deduction. As far as tax exempt you may mean that they qualify a non-profit with a 501 c 3. Either of the two lessens your tax bill but one is more advantageous than the others.

When an employee pays for benefits such as health insurance with before-tax payments the deduction is taken off their gross income before taxes. Although its primarily aimed at working parents and guardians the unemployed and full-time students may also. Any type of school payment pre-school elementary middle school or high school is not tax-deductible Rafael Alvarez founder and.

Thats why the IRS allows you to deduct certain childcare expenses on your tax return. Although kindergarten tuition isnt tax deductible the expenses for a before- or after-school care program might qualify for the child and dependent care credit. But in some states like Arizona you can.

A pre-tax deduction means that an employer is withdrawing money directly from an employees paycheck to cover the cost of benefits before withdrawing money to cover taxes. However once your child graduates and attends a college youre paying for youll start qualifying for certain education deductions. The credit is limited to a maximum of 3000 per child and 6000 for two or more children in preschool.

Theres the child and dependent care credit and the benefits through your FSA which is equivalent to a deduction. Because kindergarten programs are primarily educational in nature the IRS says that parents arent. Tax credits also directly reduce your tax bill.

August 20 2021 by Steve Banner EA MBA. That doesnt necessarily mean you cant still get some money back in your pocket. Although preschool expenses do not qualify as a tax deduction on their own right you can claim them as part of the child and dependent care credit assuming you qualify.

By Katherine Hutt Scott. Pre-tax retirement accounts are typically exempt from all employment taxes. If you are not aware a tax credit can significantly reduce your tax since it directly applies to your total bill.

Check the specific plan you offer for more details. The child care tax credit still applies if an infant in nursery school preschool or similar programs below the level of kindergarten is otherwise eligible for child care services and is therefore eligible for reimbursement for their care. In fact its not unless you or your dependent are enrolled in public education that you may be able to start.

However final regulations issued in 2007 refute this approach.

Front And Back Of A 3 Panel Brochure For The Hasd Foudation Funds Organization Community Foundation Scholarships United Way

Chicka Chicka Boom Boom Chicka Chicka Chicka Chicka Boom Boom Preschool Crafts

Is Kindergarten Tax Deductible H R Block

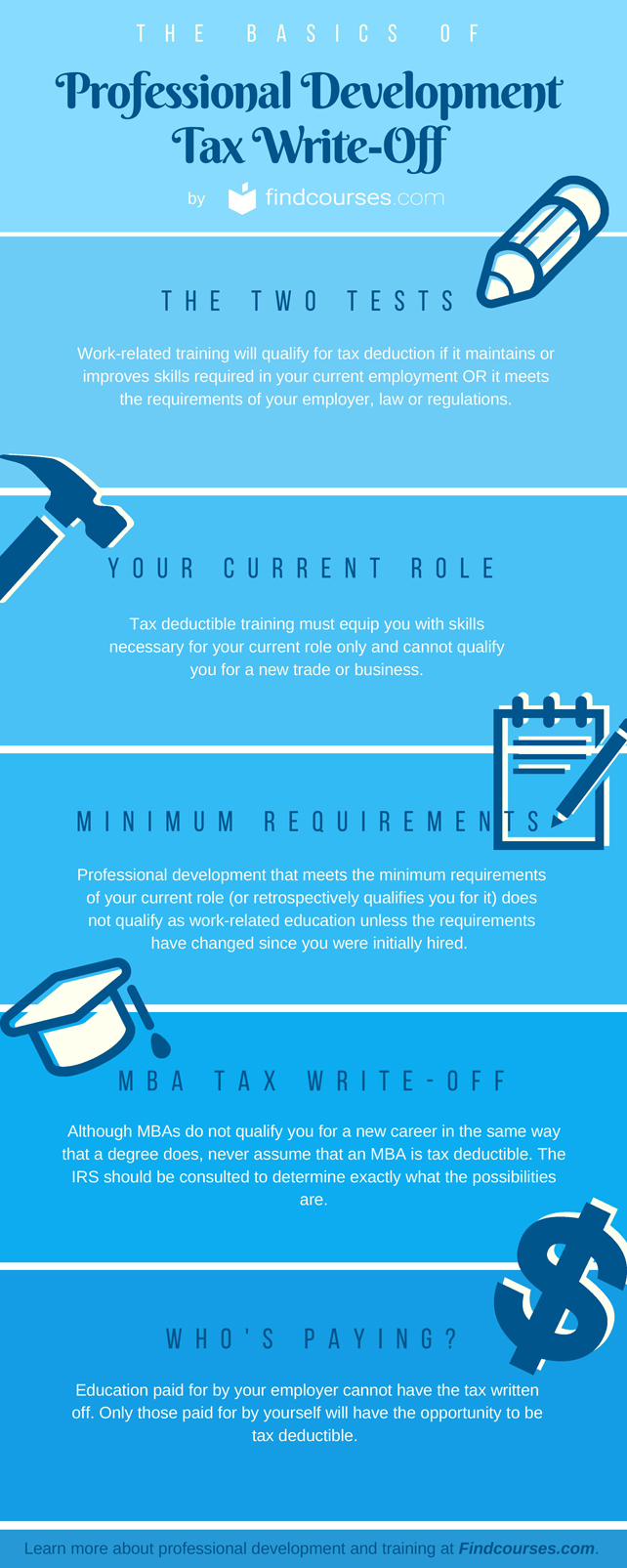

The Professional Development Tax Deduction What You Need To Know

Policies Procedures Starting A Daycare Daycare Business Plan Opening A Daycare

Is Preschool Tax Deductible Sometimes

Is Preschool Tuition Tax Deductible Motherly

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

Fish Theme Preschool Classroom Lesson Plans Preschool Lesson Plans Kids Learning Activities Preschool Lessons

Is Life Insurance Tax Deductible Permanent Life Insurance Tax Deductions Life Insurance

Is Preschool Tuition Tax Deductible Motherly

Can A Pre K Teacher Take The Teachers Deduction On The 1040

Can I Claim Expenses For Preschool As A Tax Deduction

Is Preschool Tuition Tax Deductible Sapling

Tax Deductible Receipts Donate Old Used Homeschool Books And Curriculum To Homeschool Curriculu Homeschool Encouragement Homeschool Books Homeschool Elementary

Is Preschool Tuition Tax Deductible Sapling